KiwiRail Making “Substantial progress”

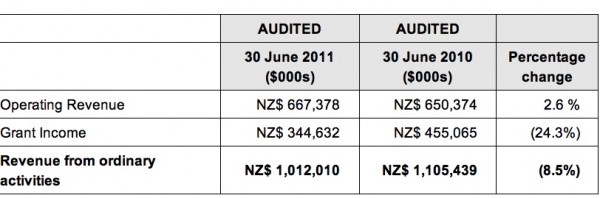

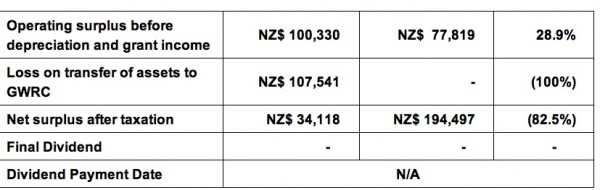

KiwiRail’s annual operating surplus, before depreciation and grant income, was just over $100 million, an increase of 28.9% on the previous year.

Operating revenue also increased despite the difficult operating conditions to $667 million, an increase of 2.6%

Releasing the company’s annual report this afternoon,. Chairman John Spencer said that despite the effects on the business of the Christchurch earthquakes, the Pike River disaster and the major slips at Kaikoura and in the Manawatu, KiwiRail still made substantial progress on its road to becoming a self-sustainable business.

Mr Spencer said while the year’s performance was positive, the results were below the Statement of Corporate Intent (SCI) targets and the company will not pay a dividend. Operating revenue of $667 million is 2.6% lower than the SCI projection, with an EBITDA result of $100 million, compared to $120.8 million.

“This is primarily due to the impact of the Christchurch earthquakes, Pike River and restructuring costs,” said Mr Spencer. “We have estimated that the impact of these events led to a reduction in EBITDA of $15 million.”

“This impact could have been much worse except for both the dedication of our teams and the network’s resilience in being able to get services running again quickly.”

Over the next year, KiwiRail is looking to increase revenue and continue to manage operating and capital expenditure. Mr Spencer said KiwiRail is optimistic that the revenue target for the 2011-12 year of $737 million can be achieved if normal operating conditions are experienced. “This will be a really interesting year for the business as we bed in the new rolling stock and introduce the improved ferry Aratere into the schedule,” he said.

“The performance of the freight business during this time was particularly encouraging,” said Mr Spencer. “We experienced growth in all freight trading categories, bulk, domestic and import/export, despite lost coal volumes due to Pike River and a dry milk season in the lower North Island.”

“Freight revenue increased by eight per cent to almost $400 million, which is approximately 60 per cent of the company’s overall revenue.”

“Of particular interest is the increase in revenue for import/export freight of almost 13 per cent, despite subdued economic conditions, and a 22% increase in agricultural produce volumes.”

This year also saw the arrival of new rolling stock, the completion of some major network improvements and the extension of Interislander’s ferry, MV Aratere, to increase freight and passenger capacity.“The business is seeing some real progress with the investment being made,” said Mr Spencer.

“The arrival of 20 new locomotives, 535 wagons and increasing the capacity and reliability of the network ensures that our business can continue to grow and improve for our customers.”

“For example we are already seeing a reduction in transit times and network caused delays, such as achieving a ten year low in mainline derailments and a reduction in speed restrictions by 10 per cent.”

Mr Spencer said Interislander business had increased revenue by over $2.7 million, but the long distance passenger business had produced a decrease in revenue by just over 24 per cent due to the Christchurch earthquakes.

“Unfortunately we had to suspend the Coastal Pacific service for six months after the February earthquake,” he said. “But this service and the Tranz Alpine will get the benefit of new carriages this year which should result in an increase in future revenue,” he said.

“While Tranz Metro did improve revenue by four per cent we still have work to do to improve service levels on the Wellington Metro network. Now that the Matangi fleet is being introduced and the Wellington network upgrade is largely complete, we are achieving improvements in on time performance.”

2 Comments

Positive. While the overall direction of regional rail is pretty poor in NZ, a healthy Kiwirail means we’re in a better position to revive it (hopefully).

I really wish this were not the case IMHO, but doesn’t anyone think this doesn’t add up at all?

How does revenue down 9% somehow lead to a 29% increase in profit when more money is actually being spent, no lines have been closed and redundancies haven’t taken place yet?

How does a $117million loss for the first 6 months (http://www.aktnz.co.nz/2011/03/02/kiwirail-posts-117m-deficit/) magically turn into a $34m bottom line profit for the full year despite the major earthquake happening in the second half?

Why did KiwiRail give $108m to GWRC? What was the business rationale?

Why didn’t the company pay a dividend? It pretty much made its target

It’s an extraordinary turnaround which no one has explained. Perhaps the bean counters among us can shed some light.